More than a year after city leaders introduced additional regulations to alleviate vacation rental oversaturation in certain areas, evidence suggests the measures may achieve their intended effects. It is shown. Despite recent sensational claims that house prices in the city are in “free fall,” the data paints a different, less dramatic scenario.

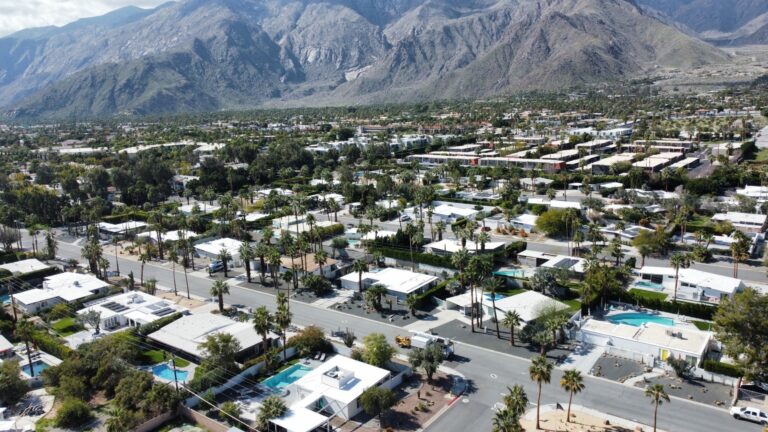

The Palm Springs City Council enacted strict restrictions in November 2022 after community members voiced concerns about the rapidly increasing number of short-term rentals. Primarily targeted at desirable neighborhoods like Racquet Club Estates, where vacation rentals accounted for nearly 40% of the housing, the new regulations limited short-term rental density to 20% in 10 high-density neighborhoods.

City data shows applications for vacation rental permits have slumped, especially when compared to the surge experienced during the pandemic.

The number of registrations increased by 279 between December 2022 and January 2024, but this figure also includes applications that were suspended due to the fall 2022 moratorium. Once the moratorium ended and the backlog cleared, the data showed a more modest increase in claims, with just 81 applications in the 10 months ending in January of this year.

Prior to the enactment of this ordinance, the year-over-year increase in enrollment was even more significant. For example, from January 2021 to 2022, enrollment increased by 242 people. Between January 2022 and January 2023, enrollment increased by 437 people.

Another purpose of the ordinance was to improve housing affordability by preserving potential full-time housing. In this regard, the data shows that there is still work to be done.

In Palm Springs, the median price for an average-sized single-family home is down 2.7% from a year ago, from $1.2 million to about $1.18 million, according to the latest housing report published earlier this month. Prices in the rest of the Valley fell 1.8% year over year.

According to Redfin’s calculator, the average home for sale in the city requires a buyer’s household income of about $330,000. However, the median household income for city residents is $67,451, according to recent census data.

Redfin uses these numbers to estimate that the average homebuyer in the city should be looking at a home in the $260,000 range. There are only 24 one-bedroom, one-bathroom condos currently for sale in Palm Springs in this price range.

Are sellers struggling too? The answer requires some context.

In 10 areas with caps on short-term rental licenses, homeowners who bought homes in recent years and were looking to cash out said they were facing difficulty getting the asking price.

Real estate agent David Carden said it’s a familiar lament, in part because of a noticeable trend. Homeowners aim to sell properties purchased at peak prices in hopes of profiting from the short-term rental market, but this strategy is proving increasingly unfeasible.

“They expect to rent [the houses] The prices are exorbitant,” Carden said of vacation permit applicants. “They don’t want to be realistic about pricing and the value of real estate.”

“Sellers who bought at the height of the market, when home prices were rising 10%, 20% a year, are still trying to make a sizable profit. And the market isn’t supporting that, and it’s not sustainable.” .”

— David Carden, Realtor

From 2022 to 2023, after the ordinance change was passed, prices for single-family homes in areas with caps on vacation rental permits fell by about 14%. However, the decline came after historic price increases over the past few years.

From 2019 to 2020, prices in these regions increased by approximately 9%. From 2020 to 2021, prices increased by 35%. And from 2021 to 2022, prices increased by 33%.

“Sellers who bought at the peak of the market, when home prices were rising 10%, 20% a year, are still looking to make a decent profit,” Carden said. “And the market isn’t supporting it. It’s not sustainable.”

“They don’t really want to be part of the community,” he added. “They’re buying it to be part of a mini-hotel district.”

Large fluctuations in home prices are not unique to Palm Springs. As city officials were debating updating vacation rental ordinances in fall 2022, experts across the country were warning of an impending price correction (due in part to rising interest rates) after the pandemic-era boom. In September 2022, Redfin reported that 19% of sellers reduced their asking price.

According to U.S. News & World Report, the most significant price corrections are expected in pandemic-era “Zoomtowns,” including Boise, Idaho, Greeley, Colorado, or Palm Springs, as Carden points out. This includes places such as.

The Riverside-San Bernardino-Ontario real estate market, which includes Palm Springs, was rated the fourth most overvalued housing market in the country.